prince william county real estate tax assessment

And the collection of all local taxes including real estate and other related fees for Prince William. Impr - Market Value.

Prince William County Budget Set For Approval Residents Can Expect To See Tax Bills Tick Up Wtop News

Use both House Number and House Number High fields when searching for range of house numbers.

. In Prince William County Virginia the tax rate is 105 which is substantially above the state average. This estimation determines how much youll pay. Click here to register for an account or here to login if you already have an.

Hi the county assesses a land value and an improvements value to get a total value. Enter your payment card information. Dial 1-888-2PAY TAX 1-888-272-9829.

Prince William County Virginia Home. The Taxpayer Services in-person and telephone office hours. Market value is the probable amount that the property would sell for if exposed to the market for a reasonable period with informed buyers and sellers acting without undue pressure.

Mmddyyyy mmdd. While the Office of Real Estate Assessor has attempted to ensure that the data contained in this file is accurate and reflects current property characteristics the County of Prince George makes no warranties expressed or implied. Account numbersRPCs must have 6 characters.

Report changes for individual accounts. Then they multiply that by the tax rate to get your property tax. Use both House Number and House Number High fields when searching for range of house numbers.

Information on your propertys tax assessment. Total - Market Value. Reporting upgrades or improvements.

In Prince William County a personal property tax is assessed annually as of January 1 on automobiles trucks motorcycles trailers and mobile homes. All you need is your tax account number and your checkbook or credit card. Total - Market Value.

Real estate tax rate. Ad Search Public Property Records In Prince William County By Address. Enter the house or property number.

Ad Enter Any Address Find Previous Property Owner Records for Your State. Enter jurisdiction code 1036. The Prince William County Assessor is responsible for appraising real estate and assessing a property tax on properties located in Prince William County Virginia.

You can contact the Prince William County Assessor for. You may appeal to the Circuit Court of Prince William County within three years of the assessment. Prince William County real estate taxes for the first half of 2022 are due on July 15 2022.

To make matters worse for residential property owners property tax bills. The average yearly property tax paid by Prince William County residents amounts to about 32. Payment by e-check is a free service.

Impr - Market Value. Provided by Prince William County Communications Office. Land Use Value.

Ad Get your property assessment and tax data with our database. Prince William County collects on average 09 of a propertys assessed fair market value as property tax. The Prince William County assessors office can help you with many of your property tax related issues including.

All real property in Prince William County except public service properties operating railroads interstate pipelines and public utilities is assessed annually. When tax assessors estimate the value of your property they multiply that number by the tax rate of the county. Prince William County real estate taxes for the first half of 2022 are due on July 15 2022.

The Prince William County Tax Assessor is the local official who is responsible for assessing the taxable value of all properties within Prince William County and may establish the amount of tax due on that property based on the fair market value appraisal. By creating an account you will have access to balance and account information notifications etc. The property tax calculation in Prince William County is generally based on market value.

You will need to create an account or login. These candidates tax assessments are then matched. You can read more at Propety Taxes in Prince William County Virginia.

A convenience fee is added to payments by credit or debit card. You can pay a bill without logging in using this screen. If you have questions about this site please email the Real Estate Assessments Office.

Make a Quick Payment. If you are searching by gpin please enter it in the following format. Land Use Value.

Proposed county tax rates. Enter the house or property number. Find Information On Any Prince William County Property.

Prince William County property and vehicle owners will face higher tax bills in 2023 but the increases likely wont be as high as initially expected as a result of the latest changes to the proposed budget county supervisors considered Tuesday. Press 1 to pay Personal Property Tax. Then they get the assessed value by multiplying the percent of total value assesed currently 100.

Enter street name without street direction NSEW or suffix StDrAvetc. Press 2 to pay Real Estate Tax. Enter the house or property number.

If your account numberRPC has less. Than 6 characters add leading zeros to it before searching. Comments may be made by telephone at 804 722-8629 or via e-mail to assessorprincegeorgecountyvagov.

Enter the Account Number listed on the billing statement. Report a Change of Address. Appealing your property tax appraisal.

If you are searching by sale date please enter it in the following format. Learn all about Prince William County real estate tax. Online access to all tax records and real property records.

The system will verbally provide you with a receipt number for you to write down. The Department of Tax Administration is responsible for uniformly assessing and billing personal property taxes business license tax business tangible tax Machinery and Tools Transient Occupancy tax Utility Taxes Public Service and Bank Franchise. Land - Market Value.

Use both House Number and House Number High fields when searching for range of house numbers. July 2 2022. Land - Market Value.

Often a resulting tax assessed. Prince William County has one of the highest median property taxes in the United States and is ranked 120th of the 3143 counties in order of median property taxes. Whether you are already a resident or just considering moving to Prince William County to live or invest in real estate estimate local property tax rates and learn how real estate tax works.

Business are also assessed a business tangible property tax on items such as furniture and fixtures computers and construction equipment.

Data Center Opportunity Zone Overlay District Comprehensive Review

Prince William Board Of County Supervisors Adopts Fy2023 Budget Prince William Living

Prince William County Budget Set For Approval Residents Can Expect To See Tax Bills Tick Up Wtop News

Where Residents Pay More In Taxes In Northern Va Wtop News

Prince William County Launches A New Show Called County Conversation

Prince William Board Adopts Plan For Data Center Tax Hikes Headlines Insidenova Com

Northern Virginia Residential Property Tax Rates And Due Dates Smart Settlements

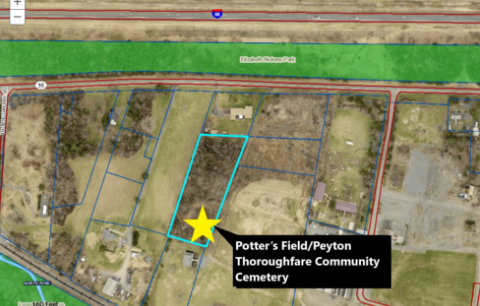

Prince William Board Of County Supervisors Approves Land Purchase In Historic Thoroughfare Community

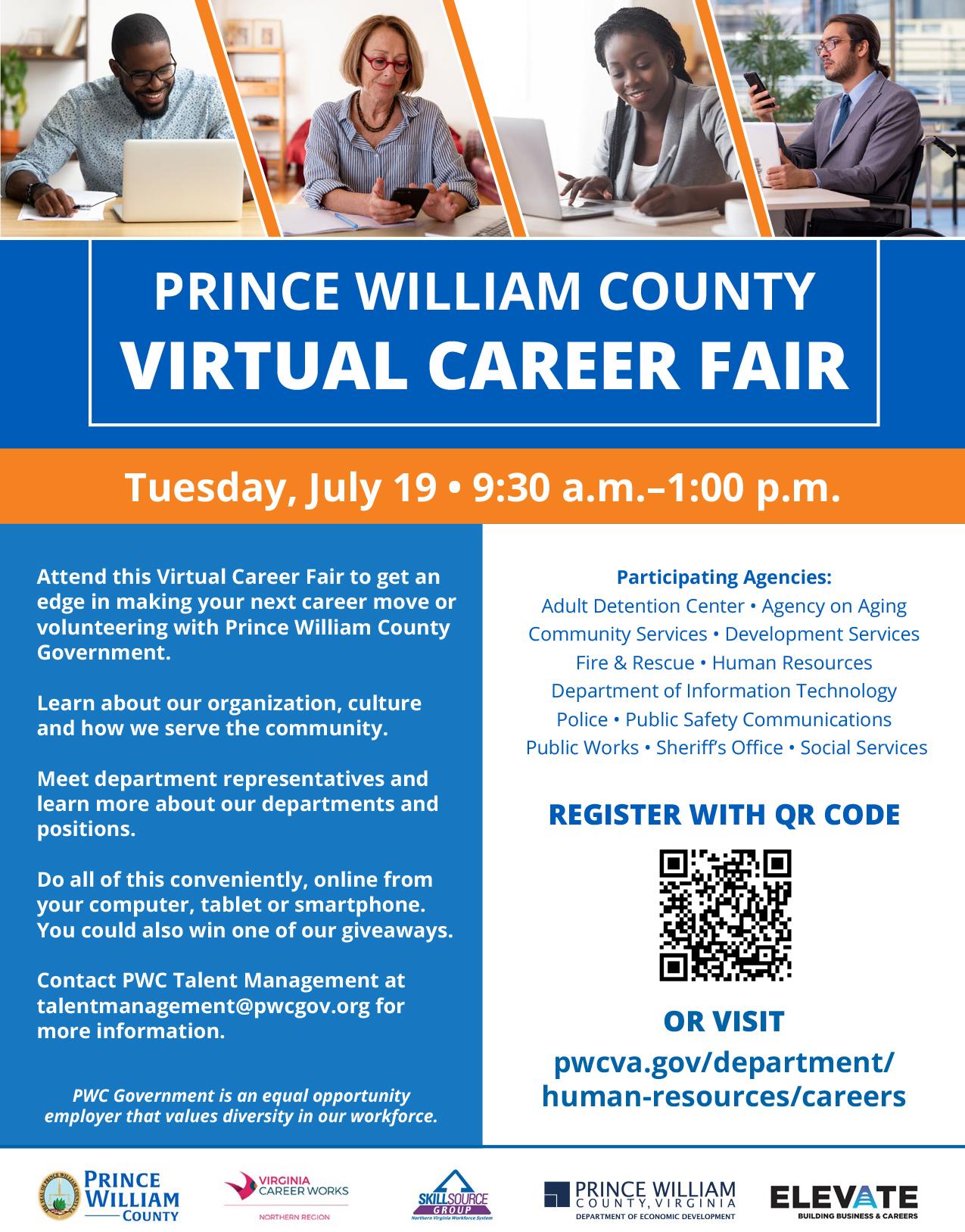

Prince William County Virtual Career Fair

Gop Prince William Supervisors Criticize Tax Increase Headlines Insidenova Com

First Half Of 2020 Real Estate Taxes Due July 15 Prince William Living

Landfill And Compost Facility Safety Guidelines

The Rural Area In Prince William County

Prince William Officials Propose Further Cut In Tax Rate Reduction In Vehicle Assessments Headlines Insidenova Com

Prince William Wants To Hike Property Taxes Introduces Meals Tax

%20.jpg)